Office Time

Mon-Sat: 8am to 8pm

Oman ranks among the top economies in the Middle East with the most positive growth prospects. However, there are many challenges business owners face when they begin their venture in Oman.

Starting your business involves registering a legal company. As a first step for company registration in Oman 2025, you will need a Chamber of Commerce and Industry affiliation certificate. Also, you will need shareholders’ visas, passports, and other important documents.

This is a complete guideline for you to register your company and business setup in Oman. Let’s discover all the steps.

Table of Contents

Oman’s Vision 2040 has made the country a favorite place for businessmen. The country will provide you with a stable business structure. Oman offers an excellent environment to grow your business setup. Also, this country stands out as a suitable business location in the Middle East, thanks to its thriving economy and attractive business framework, plus its ideal regional position.

There are some other factors that you can consider while choosing Oman as your business hub:

Before planning a business setup in Oman, you must gather the legal documents. The legal documents are valid for setting up a business in Oman, both locally and internationally. Furthermore, the Omani law demands that you have these documents whether you are a foreign or local businessman in Oman.

The documents you will need before starting a business are:

These documents ensure your initial approval for your business setup in Oman.

As discussed earlier, setting up a business in Oman is a multi-layered process. You must register your business first. The registration process can be overwhelming.

For your ease, we have outlined 10 crucial rules that you can follow before registering your business in Oman.

| Rules | Details |

| #1 Choose a Unique Business Name | Select a name for your business that has never been used before. |

| #2 Determine Business Activities | You must clearly explain what your business is and what service you will provide. |

| #3 Select Legal Structure | Choose the type of company (LLC, joint-stock, sole proprietorship). |

| #4 Prepare Required Documents | Collect necessary documents such as identification, lease agreements, partnership contracts, contracts, and other relevant records. |

| #5 Obtain Initial Approvals | Obtain permits from the appropriate authorities for particular business operations. |

| #6 Register with MOCIIP | Submit your application to the Ministry of Commerce, Industry, and Investment Promotion. |

| #7 Register for Taxes | Register with the Tax Authority for a Tax Identification Number (TIN) or Tax Registration. |

| #8 Open a Bank Account | Open a Corporate Bank Account in a Local Bank in Oman |

| #9 Obtain Municipality License | Obtain a local municipality license for where your business is located. |

| #10 Register with the Chamber of Commerce | Registration of your business with the Oman Chamber of Commerce. |

In Oman, you will find many business platforms for the company registration process. The offices offer guidance, support, and services to ease the process. With offices from Muscat to Dhofar, they help you to fulfill the business requirements and regional functions.

For your better understanding, we have summarized the services these offices offer:

| Offices | Services |

| Invest Easy Call Center | You will get centralized support for questions and assistance in the business registration process. |

| Muscat | This is the capital city with the most service offices for business setup. |

| Dhofar | A key southern hub for agricultural businesses, logistics and trade. |

| Al Buraimi | Famous for its industrial and port activities, ideal for industries engaged in manufacturing and export. |

| Sur | Provides services to companies connected to the shipbuilding and tourism sectors. |

| Al Rustaq | Promote local businesses such as agriculture and small-scale industries. |

| Nizwa | A high point of business events for the culture and tourism sector. |

| Ibra | Provides support for businesses in eastern Oman, particularly in agriculture and crafts. |

| Ibri | It serves businesses in western Oman, including logistics and natural resources. |

| Mosandam | Work to support the businesses in this strategic location, emphasising tourism and port services. |

In Oman, company formation and company registration are a multilayered process. We have narrowed it down to 5 steps.

The first step is to select what kind of business structure you want to build. Then, you have to find a suitable area according to your business structure. Finally, you must choose a unique name for your business.

To select your business niche, you must understand different business entities, such as:

After selecting your niche, you must choose the area for your business setup. Your business structure is dependent on the area of your business. The free zone company setup areas offer great business opportunities, such as:

Special Economic Zone at Duqm (SEZAD): The area functions as a top industrial and logistics centre through its green hydrogen and steel production.

SOHAR Port and Freezone: This hub hosts all major petrochemical industries and supports logistics and manufacturing from its cost-effective power rates and convenient location.

Salalah Free Zone: From this location, companies can access easy access to major market regions, including the Middle East Africa and Asia, while benefitting from Salalah’s port advantages as one of the world’s biggest container ports.

Al Mazunah Free Zone: Strategically positioned on the Yemen border, this special area helps firms in manufacturing and service activities while lowering costs and simplifying operational regulations.

Khazaen Economic City: The development project creates an integrated business and residential area that features different industries plus sustainable design and state-of-the-art facilities.

You must understand the business structure on the mainland and the free zone of Oman. Here, you can get a clear idea of the differences between the mainland and the free zone area :

| Options | Mainland | Free Zone |

| Ownership and Control | 100% foreign ownership allowed but may require a local agent | 100% foreign ownership with no local agent required. |

| Taxation | Corporate tax rate of 15% on net profits. | Corporate and income tax exemptions for up to 10 years in certain free zones. |

| Customs | Standard customs duties apply to imports and exports | Restricted to free zone areas |

| Geographics Restrictions | Offices can be set up anywhere in Oman. | Offices are restricted to designated free zone areas. |

| Omanization | 15% | Vary by free zone, typically ranging from 10% to 30%. |

| Market Access in Oman | Full and unrestricted access to the local Omani market. | Limited direct access; additional licensing is needed for trading within Oman. |

| Internation Trade | Requires standard export permits and customs clearances. | Ideal for international trade, with streamlined export processes and global connectivity. |

| Setup Process | 10 to 14 days | 1 to 2 months |

| Price | For LLCs, branches or joint ventures – OMR 150-500 (USD 380- 1290) | OMR 1500 – 3000 (USD 3890 – 7790) |

| Business Scope | Best for targeting Omani customers and local industries. | Best for focusing on exports, re-exports, and global trade. |

Now, you have to choose a unique name for your business. The name should be relevant to your business. To register your business name, you will need to follow the guidelines of the Ministry of Commerce, Industry, and Investment Promotion (MOCIIP).

Read More: How to Start a Business in Dubai from Scratch with 100% Ownership?

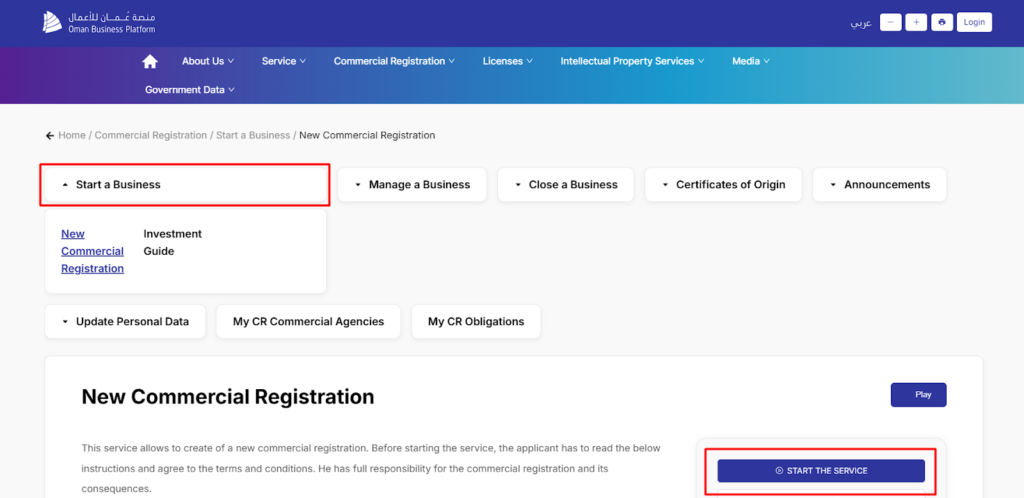

In this step, you will have to visit the Official Business Website of Oman and register your business from there. On the website, you will see a Start a Business section. Now choose New Commercial Registration.

Here is a visual demonstration:

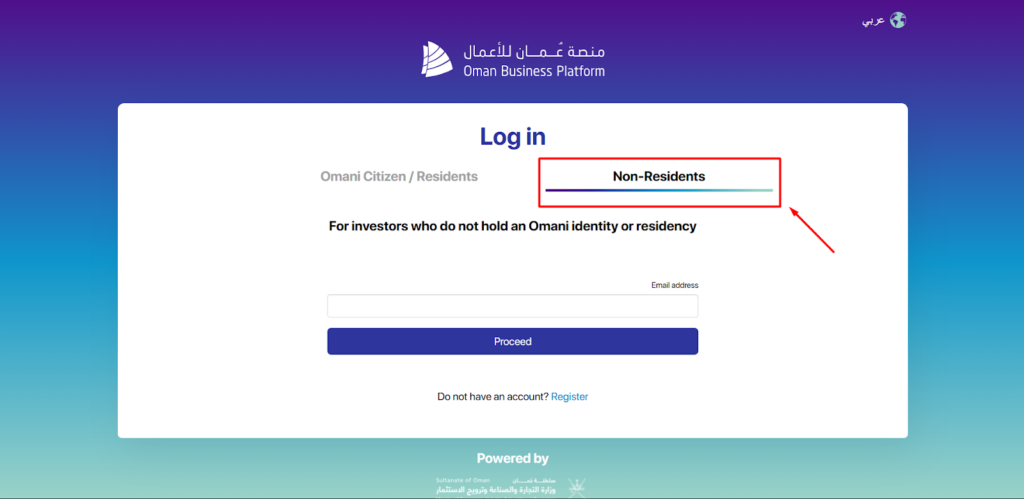

On the login page, you must choose your identity or residency. As a foreign investor, you must choose “Non-Residents” and then proceed.

Depending on the zone and business structure, the company registration fee is different in Oman.

As a non-resident businessman, your company registration fees should be around 150–1,000, depending on the business type and location. Chamber of Commerce registration is approximately OMR 100–500 annually.

Notarization and document attestation costs may range from OMR 50–300. Business license fees could be between OMR 200–1,000 annually. Office lease costs can range from OMR 3,000-15,000.

The cost of Oman residence visas for employees could be OMR 50-200 per visa, and municipal fees are typically between OMR 50-500 annually.

This is the crucial step to start your business. You need approval from different ministries of Oman. Here is a list of ministries from where you need approval:

| Ministry | Category |

| Ministry of Commerce, Industry, and Investment Promotion (MOCIIP) | Business name approval and company registration certificate. |

| Royal Oman Police (ROP) | Security clearance for business activities and visa approvals for employees. |

| Ministry of Housing and Urban Planning | Approval for office lease agreements and land use for commercial purposes. |

| Oman Chamber of Commerce and Industry (OCCI) | Registration and membership for business activities. |

| Ministry of Finance | Tax registration and issuance of tax numbers for businesses. |

| Ministry of Environment and Climate Affairs | Environmental clearance for businesses that might impact the environment. |

| Ministry of Health | Approvas for health-related businesses such as clinics, pharmacies, or food businesses |

| Ministry of Labor | Work permits for hiring foreign employees. |

After completing the previous steps, you have to wait for 7 – 12 days to get the approval for the company registration. For the visa processing, you will have to wait 20 – 30 days.

BlackSwan Can Assist You to Register Your Business in Oman!

To open a business in Oman just for the business license fees and company registration fees can cost a total of OMR 300 – 1150.

With additional fees such as initial capital, legal and consulting fees, marketing costs, visa & labour costs, and office space rent, the total cost of your business can range from OMR 2250 – 15400

The corporate tax rate in Oman is 15% for all business setups. But for small business structures, the tax rate is 3%.

The benefits of working in Oman are:

➡️ Stable Economy

➡️ Tax flexibility

➡️ Business friendly regulations

➡️ A strategic location for business

➡️ Multicultural environment

➡️ Developed infrastructure

There are 4 types of graded companies in Oman. The Grade 4 company in Oman means that the company will have the highest foreign ownership with a minor share held by an Omani National. The Grade 4 companies are ideal for foreign business setups.

Oman’s Economic Diversification Vision 2040 has made the country an ideal place for starting a career. In Oman, the jobs with high demand are:

➡️ Cyber Security Specialist

➡️ Data Analyst

➡️ Civil Engineer

➡️ Healthcare Professionals

➡️ Software Developer

➡️ Tourism and Hospitality Manager

The Vision 2040 initiative of Oman has boosted the country’s economy by miles ahead. Right now, world-leading companies are trying to expand their businesses in Oman.

So, for your business setup in Oman, you will need to register your company, then choose a business area with a unique business name and complete the other additional requirements.

Hope this blog has solved all your queries about starting a business in Oman. Thank you for your time.